[vc_section full_width=”stretch_row_content” content_placement=”middle”][vc_row css_animation=”fadeIn” css=”.vc_custom_1620839260660{background-color: #00c4c4 !important;background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}” el_id=”customsticky”][vc_column width=”2/3″ el_class=”customcolumn stickycolumn”][vc_empty_space height=”15px”][vc_row_inner][vc_column_inner width=”5/6″ offset=”vc_hidden-sm vc_hidden-xs”][vc_column_text]

30 DAY FULL REFUND GUARANTEE If you are not totally happy

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/6″][porto_buttons btn_title=”Subscribe Now” btn_link=”url:%23subscribeform|||” btn_align=”porto-btn-center” btn_size=”porto-btn-small” btn_title_color=”#000201″ btn_bg_color=”#f6c001″ btn_hover=”porto-btn-fade-bg” btn_bg_color_hover=”#ffffff” btn_title_color_hover=”#020202″ btn_font_style=”500″ btn_font_size=”16″][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content” content_placement=”middle” el_class=”headingsection”][vc_row css=”.vc_custom_1620409105454{background-image: url(https://hedgefundalpha.com/wp-content/uploads/2021/03/salsepagebg-Recovered2.jpg?id=2098983) !important;background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}”][vc_column width=”2/3″ el_class=”customcolumn”][vc_empty_space][vc_column_text css=”.vc_custom_1621352107099{background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}”]

Take your investment to the next level

Take your investment to the next level

High- Upside Recommendations in depth case studies

[/vc_column_text][vc_column_text][/vc_column_text][porto_buttons btn_title=”7 Day free trial” btn_link=”url:https%3A%2F%2Fhedgefundalpha.com%2Fvwp-7-day-free-trial%2F%23subscribeform|||” btn_align=”porto-btn-center” btn_size=”porto-btn-large” btn_bg_color=”#f6c001″ btn_hover=”porto-btn-fade-bg” btn_bg_color_hover=”#00c3c3″ btn_title_color_hover=”#000000″ el_class=”freetrialbutton” btn_font_style=”800″ btn_font_size=”30″][vc_empty_space height=”60px”][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content”][vc_row css=”.vc_custom_1620497724713{background-color: #ffffff !important;background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}”][vc_column width=”2/3″ el_class=”customcolumn” css=”.vc_custom_1621405129515{padding-top: 20px !important;padding-right: 20px !important;padding-bottom: 20px !important;padding-left: 20px !important;background-color: #ffffff !important;}”][vc_empty_space height=”60px”][vc_column_text]

How to find them and mimic them

Dear Hedge Fund Alpha Reader,

Here’s a true story about my unique investment journey.

Let’s head back to the 1999s and early 2000s… the tech bubble … the crash … and all that.

I was just a kid and loved following the gyrations of the stock market. I somehow convinced my parents to give me a few thousand dollars. I proceeded to pile it all into AOL stock.

But …

And something crazy happened

I made thousands of dollars. My profits were something like six-fold within just a few months. In hindsight, I was very lucky but thought I was a genius investor. I gained confidence in investing and proceeded to make more recommendations.

What happened next?

I proceeded to lose that money slowly over the next few years until I lost way more than my AOL profits. Long/story short, I started consuming information like never before to educate myself and learn everything I could. Warren Buffett and Charlie Munger influenced me the most and helped me develop a proper investing strategy. I used their philosophy to make a killing when the market crashed in 2008 and 2009, picking up companies like American Express at $12 a share and holding for many multiples of gains over the next year or so.

But here’s the thing …

At that point in life, I was a full-time analyst. It takes a lot of time to research even small companies. So what do I like to do?

I like to look at the best hedge funds and see where they are betting.

Now when I say the “best”, I am not talking about the big ones you read about managing billions of dollars. Many are super talented like Dan Loeb, but many are not and have lost their touch. More importantly, Bloomberg and CNBC’s obsess over big names that manage too much money to make wise picks. They all buy the same 100 biggest stocks, which works great if those are going up. They are limited to a microscopic universe of stocks. In fact, there are about 10,000 stocks just in the U.S.; the VAST MAJORITY are small names that are too small or illiquid for a brilliant investor like Loeb to bother with; this leaves the space with many bargains for those who know where to luck.

Please don’t take MY word for it; here is what the greatest investor of all time says.

“If I had $10,000 to invest, I would focus on smaller companies because there would be a greater chance that something was overlooked in that arena. The highest rates of Return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money.I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that. But you can’t compound $100 million or $1 billion at anything remotely like that rate.” Warren Buffett

Meanwhile, there are 10,000 other public companies just in the U.S. which barely get any press. Additionally, about 10,000 hedge fund managers in the U.S., the vast majority managing below $1 billion. Some of these fund managers have fewer assets under management and are not looking to earn fat 2/20 fees and invest in some real gems.

I am talking about cases like net-nets where sometimes the company is trading for less than the cash on its balance sheet. That is rare (although it happened during the 2009 crash), but those are the types of gems I am talking about.

Now not all those managers are good, many are not, and there is a reason some have fewer assets. But some have not been found yet or are not good at advertising. Some do not want to get too big and close to new investors at a certain AUM threshold so they can stay nimble. I track some of the best of them. While probably no one alive is as good as Buffett to earn 50% returns, but these managers are producing 15-25% returns annually by investing in incredible under the radar, small companies.

Why Members of the Hedge Fund Alpha Follow Me …

My name is Jacob Wolinsky, and I am the CEO and founder of ValueWalk.

I spent years working with small-cap equities before working in business development for hedge funds and financial journalism.

Even though I was successful in that career, I wanted more flexibility, and today, I had started ValueWalk on the side as a hobby in 2012. The site started to pick up momentum, and to gain control over my destiny, I started running ValueWalk in 2012 as a full-time job.

I base my “recommendations” on what I learned from the best investors.

You can see some of their stock picks and their investment style below.

Now … I don’t want to boast too much because that’s not my style … but …I want you to ask can you find this anywhere else?

If you do, please send me an email as I am curious to know.

The people who follow me are …

- Major hedge fund CIOs

- Highly independent thinkers

- Risk-averse

- Wary of the latest momentum trends

- Looking for value … but unwilling to spend 9 hours every day looking for undervalued stocks.

And there’s something else you should know… Something I believe is significant… I am 100% impartial. To avoid conflict of interest, I have long ceased investing in individual stocks; I have no incentive for an equity to go up or down. There is no “pumping” by me. I am not trying to get you to trade frequently to earn commission fees.

Like you probably are, I’m incredibly risk-averse … my #1 goal is the preservation of capital. I NEVER recommend anything I believe is too risky due to bad management, poor prospects, or other negative factors. In fact, when I was still buying individual stocks using Buffett’s methods over the past decade-plus, I don’t recall a single time I purchased security that went bankrupt (and I was very diversified, so you would think at least a few holdings would hit zero).

There’s no reason to feel pressured to put money in a risky momentum investment or fad.

So…

Let me explain my “non-secret” method of investing…

Check out CNBC, and you will find pundits making bold predictions of what the markets will do. Beware! There is no magic formula, and many are pitching their portfolio to juice returns. Even if that is not their goal, they just follow the herd and their returns are not special.

I scour markets looking for top fund managers and their favorite securities… I’m looking for fund managers who are quietly building fortunes for their investors. I look for ones who find good quality companies trading at incredible multiples.

This takes a lot of time but it is what I do every day and have been doing for many years.

A great example… check out Breach Inlet Capital, a hedge fund I profiled in March 2019. The Dallas based hedge fund run by Chris Colvin keeps a low profile and focuses on companies below $3 billion, which the crowded money tends to avoid, as I explained above. I would have never encountered the fund if not for my large and growing hedge fund contacts network.

At the time, Chris recommended a small company named IES Holdings (Ticker IESC). Why? Here is what he said emphasis mine:

IES Holdings is a ~$400 million market cap company that does not host earnings calls and has zero analyst coverage. These types of “under-the-radar” investments are appealing due to a higher probability of mispricing. Also, this business certainly meets our investing criteria with:

1) an incremental return on invested capital of 30%+ over the past six years

2) a phenomenal capital allocator with ~60% ownership leading the Board

3) a favorable valuation at only ~10x estimated 2019 cash EPS

4) an accretive acquisition plan to create upside for shareholders.

On paper, the stock looked expensive with a forward PE of 208! Chris noted due to “ GAAP earnings, which are distorted by amortization from acquisitions and phantom taxes”, but if you dug deep, it was cheap, very cheap.

You cannot screen for those companies; you need to search (and search incredibly hard) to find them. Or you can locate an incredible fund manager who you know and trust, who has done most of the initial work for you.

Our readers got the recommendation right after Chris finished his interview with us.

The results speak for themselves. Green is IESC, and the blue line is the S&P 500.

How I Achieved 21.46% Annual Returns

Once I find a top manager, I try to focus on the following.

- Extremely risk-averse

- Regulatory background

- Professional and personal background

- Strong cash flow

- Ideally, in the United States or country with solid capital markets like Canada, and the UK

- Strong potential for growth/turnaround

Remember … I have been working with hedge funds for 10+ years and have experience as an equity analyst in accounting. In fact, I was originally an accounting major. As such, I have expertise and intuition in which funds are good and which to profile. I get many recommendations, but I constantly reject them if they don’t meet my criteria.

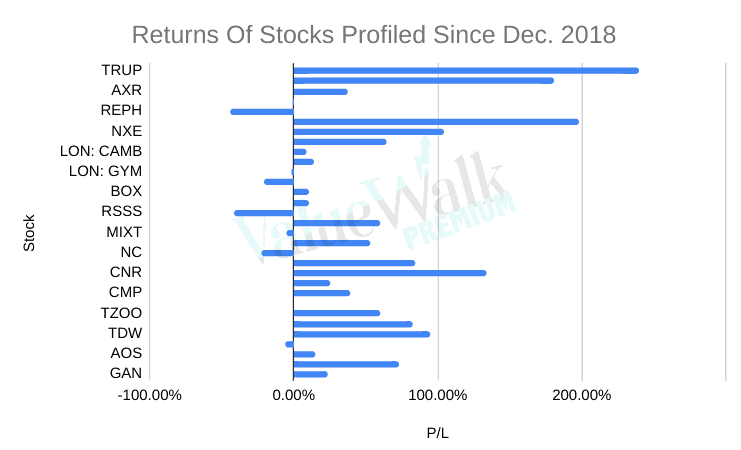

But when I decide, it is usually a winner. Over the past two years I have highlighted 31 small caps in particular from 16 hedge fund managers I respect. At the time of this writing these 31 stocks have averaged a total of 47.5% from the time of publication. This works out to 21.46% annual returns, and we are not cherry picking data this is based on ALL picks, if you had chosen a few superior ones your returns would be even higher. Here is a list of those returns so you can see for yourself. Subscribers get access to those picks immediately.

And, when you join Hedge Fund Alpha. You gain access to all this content.

[/vc_column_text][vc_empty_space height=”60px”][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content” css=”.vc_custom_1620560514288{background-color: #f5f5f5 !important;}”][vc_row gap=”20″ css=”.vc_custom_1620562478694{background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}”][vc_column width=”2/3″ el_class=”customcolumn”][vc_empty_space height=”60px”][vc_row_inner][vc_column_inner][vc_empty_space][vc_column_text]

Take a Look at 4 Case Studies

Want proof this works? Take a look at these recent recommendations.

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner gap=”15″][vc_column_inner el_class=”casestudy4″ width=”1/2″][vc_empty_space][vc_single_image image=”2100501″ alignment=”center”][vc_column_text css=”.vc_custom_1620797773790{padding-top: 20px !important;padding-right: 20px !important;padding-bottom: 20px !important;padding-left: 20px !important;}”]

Profit in a few days

In an exclusive conference hosted by ValueWalk, my colleague and top short-seller Gabriel Grego unveiled the problems he had uncovered with streaming stock-based in London named Akazoo (NASDAQ: SONG, recommending people bet against it… A trade that would have yielded over 45% in just a few days if timed correctly until the stock was ultimately delisted. While 45% is impressive, the annualized return on that trade is out of this world.

[/vc_column_text][/vc_column_inner][vc_column_inner el_class=”casestudy4″ width=”1/2″][vc_empty_space][vc_single_image image=”2100502″ alignment=”center”][vc_column_text css=”.vc_custom_1620797807994{padding-top: 20px !important;padding-right: 20px !important;padding-bottom: 20px !important;padding-left: 20px !important;}”]

profit in 48 hours

At another exclusive conference held by ValueWalk on June 3rd, top European Shortseller, Siegfried Eggert the founder of Grizzly Research Founder, recommended Nisun International Enterprise Development Group Co., Ltd (NASDAQ: NISN) (formerly Hebron Technology Co Ltd (NASDAQ: HEBT) as a short.

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner gap=”15″][vc_column_inner el_class=”casestudy4″ width=”1/2″][vc_empty_space][vc_single_image image=”2100503″ alignment=”center”][vc_column_text css=”.vc_custom_1620797837903{padding-top: 20px !important;padding-right: 20px !important;padding-bottom: 20px !important;padding-left: 20px !important;}”]

Return

But wait, Jacob, I am not into shorting; it’s risky. Yes, I totally understand that and agree with you; I believe short selling is essential but very nerve-racking. However, shorting is good even if you do not do it to learn what to AVOID. And more importantly, Here’s the thing we don’t just profile shorts; we do longs the vast majority of the time.

On June 30, 2018, I conducted a special subscriber-only interview with the brilliant portfolio managers at Left Brain Capital. At the time, I asked them for their top portfolio pick, and they shared The Trade Desk, Inc. (TICKER: TTD), which my subscribers got in their inbox right away.

At the time, TTD was trading at $94.20. Guess where it is today? At the time of this writing, the stock is at $826.74. That is over 800% return in under three years![/vc_column_text][/vc_column_inner][vc_column_inner el_class=”casestudy4″ width=”1/2″][vc_empty_space][vc_single_image image=”2100504″ alignment=”center”][vc_column_text css=”.vc_custom_1620797869895{padding-top: 20px !important;padding-right: 20px !important;padding-bottom: 20px !important;padding-left: 20px !important;}”]

Return

Khrom Capital is run by a brilliant, and low key investor, Eric Khrom, who also was featured in Forbes 30 under 30.

I remember meeting Eric about ten years ago and was struck by his brilliance. He mentioned a favorite stock pick, and I found the idea intriguing but forgot the company name! I called him up a few weeks later to ask him to remind me, but the company had already been acquired….at a major premium.

A few years later, I was trying to help my parents with some investments. I strongly recommended Khrom Capital to them as a shrewd money manager who would deliver fantastic returns while minimizing risk. Unfortunately, they passed on the opportunity. What a mistake…[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space height=”60px”][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content” css=”.vc_custom_1620576660358{background-color: #ffffff !important;}”][vc_row gap=”20″ css=”.vc_custom_1620562478694{background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}”][vc_column width=”2/3″ el_class=”customcolumn”][vc_empty_space height=”60px”][vc_row_inner][vc_column_inner][vc_column_text]

Some ways our readers make money

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][vc_row_inner][vc_column_inner width=”1/3″][porto_info_box icon_size=”32″ title=”Equities”]By purchasing a well-managed, growing company that trades for very cheap, you are getting a quality asset at a low price, for many balance sheets are super important. If I like a stock, but they have too much debt relative to income, I simply pass on it. I may miss a few high fliers, which do end up with great returns, but I greatly minimize risk.[/porto_info_box][/vc_column_inner][vc_column_inner width=”1/3″][porto_info_box icon_size=”32″ title=”Avoiding risks”]Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.

Warren Buffett

While gains are great, the goal of an investor is to avoid capital loss. While most avoid shorting securities, it is vital to know which stocks to avoid and how to sniff out scams.I am in touch with the best fraud investigators alive (you met a couple of them earlier on this page and will meet many more as you subscribe), and we frequently profile and highlight what they are saying on specific securities and their approach on how to avoid the genre in general.[/porto_info_box][/vc_column_inner][vc_column_inner width=”1/3″][porto_info_box icon_size=”32″ title=”Hedge fund managers”]While we profile many interesting securities, sometimes it feels better to have a professional manager who actually oversees the portfolio day to day. We scour the country for the best under the radar hedge fund managers and ask them what their favorite picks are.

Want to know their recommendations?

You can …[/porto_info_box][/vc_column_inner][/vc_row_inner][vc_empty_space height=”60px”][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content” css=”.vc_custom_1620577548686{background-color: #00c4c4 !important;}”][vc_row gap=”20″ css=”.vc_custom_1620577569463{background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}” el_class=”customcolumn”][vc_column width=”2/3″ el_class=”customcolumn”][vc_empty_space height=”60px”][vc_row_inner][vc_column_inner][vc_column_text]

ClickBait Free Information

[/vc_column_text][/vc_column_inner][vc_column_inner][vc_empty_space][/vc_column_inner][/vc_row_inner][vc_row_inner el_class=”clickbaitsection”][vc_column_inner width=”2/3″][vc_column_text]

The primary reason I started Hedge Fund Alpha is that I was sick of chasing eyeballs for revenue goals. With a membership to support our research, we can focus on finding the best information for our readers instead of trying to satisfy advertiser requirements. Hedge Fund Alpha’s content can be accessed 24/7/365 on our website, plus we will send you a special subscriber-only email twice a week. Here’s an example of the front page of a recent Hedge Fund Alpha newsletter.

[/vc_column_text][vc_column_text]

Note: Hedge Fund Alpha is priced ridiculously low at $399 a year. We will be raising prices in the near future, possibly by a significant sum. As an example, our prices were $41 a year just a few years ago; those subscribers still pay that rate. But if you join now, you are grandfathered in. The price you pay NEVER changes. But you will need to lock that in now.

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/3″][vc_images_carousel images=”2100353″ img_size=”medium”][/vc_column_inner][/vc_row_inner][vc_empty_space height=”60px”][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content”][vc_row gap=”20″ css=”.vc_custom_1620577569463{background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}” el_class=”customcolumn”][vc_column width=”2/3″ el_class=”customcolumn”][vc_empty_space height=”60px”][vc_row_inner][vc_column_inner][vc_column_text]

Reasons to join Hedge Fund Alpha…

Here’s why great investors read Hedge Fund Alpha.

[/vc_column_text][/vc_column_inner][vc_column_inner][vc_empty_space][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner width=”1/4″][vc_icon type=”material” icon_material=”vc-material vc-material-av_timer” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”Time Saver”]

[/porto_ultimate_heading][vc_column_text]

We do all the research looking through thousands of filings and hedge fund letters to determine what is going on and what you need to know.

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/4″][vc_icon type=”material” icon_material=”vc-material vc-material-show_chart” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”We find great stocks”]

[/porto_ultimate_heading][vc_column_text]

Not just funds, you can also find out their favorite stock picks

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/4″][vc_icon type=”material” icon_material=”vc-material vc-material-cloud_upload” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”Hedge fund letter database”]

[/porto_ultimate_heading][vc_column_text]

Want to find hundreds of hedge fund letters of managers in one place? We got you covered with this fantastic tool.

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/4″][vc_icon type=”material” icon_material=”vc-material vc-material-library_books” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”Results”]

[/porto_ultimate_heading][vc_column_text]

You will get connected with some of the best hedge fund managers who are producing incredible returns. You will not FIND these managers or their stock picks on CNBC.

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner width=”1/4″][vc_icon type=”material” icon_material=”vc-material vc-material-timeline” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”Value”]

[/porto_ultimate_heading][vc_column_text]

Finding a company with more cash than its current market cap and those types of exceptional companies with hidden assets on their balance sheet.

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/4″][vc_icon type=”linecons” icon_linecons=”vc_li vc_li-settings” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”ADV tool”]

[/porto_ultimate_heading][vc_column_text]

We pick up the latest filings with the SEC and display them all in one dashboard to give you one central location to quickly scan them.

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/4″][vc_icon type=”linecons” icon_linecons=”vc_li vc_li-settings” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”13F Tool”]

[/porto_ultimate_heading][vc_column_text]

It is almost impossible to read and navigate the SEC site to see what stocks managers are buying. Every quarter we update a tool as soon as the data is available so you can view it all in one convenient location.

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/4″][vc_icon type=”material” icon_material=”vc-material vc-material-monetization_on” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”Conflict of interest-free”]

[/porto_ultimate_heading][vc_column_text]

I do not make a penny from any asset appreciation related to my publishing. I am solely interested in providing the best value possible to my readers.

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner width=”1/4″][vc_icon type=”material” icon_material=”vc-material vc-material-signal_wifi_4_bar” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”Access to my network”]

[/porto_ultimate_heading][vc_column_text]

I have access to some of the best investors in the world. You will be reading what they think, what they are buying, what they believe these markets will do next. Curious for more? Shoot me an email, and I will tell you what I know. I can even make intros sometimes.

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/4″][vc_icon type=”material” icon_material=”vc-material vc-material-stars” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”Exclusive source for information”]

[/porto_ultimate_heading][vc_column_text]

You cannot find this type of research anywhere else … it’s only available on Hedge Fund Alpha.

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/4″][vc_icon type=”material” icon_material=”vc-material vc-material-trending_down” color=”white” background_style=”rounded” background_color=”sky” align=”center”][porto_ultimate_heading main_heading=”Low Price”]

[/porto_ultimate_heading][vc_column_text]

Hedge Fund Alpha is priced ridiculously low at $399 a year. We will be raising prices soon, possibly by a significant sum. As an example, our prices were $41 a year just a few years ago. You are always grandfathered in. But you will need to lock that in.

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space height=”60px”][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content” css=”.vc_custom_1620647867981{background-color: #f5f5f5 !important;}”][vc_row gap=”20″ css=”.vc_custom_1620577569463{background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}” el_class=”customcolumn”][vc_column width=”2/3″ el_class=”customcolumn”][vc_empty_space height=”60px”][vc_row_inner][vc_column_inner][vc_column_text]

No conflict of interest…

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]Sometimes we look at exciting small-cap stocks. While these securities have some liquidity, they would not be hard for someone to manipulate. I want to avoid all appearances of profiting off my research and work. I have stopped buying stocks for many years and only invest in broad-based ETFs and mutual funds. I have no financial gain from pumping particular securities. I want you to have valuable and actionable information.[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]

What Hedge Fund Alpha is NOT

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]Hedge Fund Alpha is not meant for quick trades and speculative profits. Sometimes, that will happen, but our readers, our long term investors, focus on real businesses, not quick trades. If you are looking for pipe dreams or penny stock speculations and extremely volatile cryptocurrencies – this is not the place for you. Speculative, volatile, and incredibly high-risk gambles are not what we do here. We only look at real fund managers betting on quality companies making millions or billions already.[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]

Job #1 … Manage Your Risk

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]I shy away from anything speculative. Sure I have probably missed out on some big gains, but I have CERTAINLY missed out on some significant headaches. If you are a risk-averse investor looking for high upside securities, Hedge Fund Alpha is the place for you.[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]

Great Investors Have Great Things to Say About ValueWalk Premium

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]ValueWalk has built something unusual: There is a lot of good information helpful to investors and journalists alike on the internet and in library stacks but sifting through it for accuracy and relevance is a substantial investment in time and energy. ValueWalk puts things like good journalism, hedge fund letters, interviews, and book excerpts together in one place. It’s a resource that has added value to my career.”

– Roddy Boyd, Founder Southern Investigative Reporting Foundation (SIRF), who first exposed significant scandals, including Valeant’s Philidor and Insys Therapeutics, once most prominent Fentanyl producers executives, are now in prison.

“Valuewalk Premium is a must have for anyone interested in the hedge fund and value investing world.”

Sahm Adrangi, Chief Investment Officer Kerrisdale Capital Management LLC and among the best short-sellers today

“Jacob (Wolinsky) [ValueWalk founder] is one of the most honest men I know. Who else would write this stuff?” Jim Osman CEO, The Edge® (special situation investment consultant)

“A wonderful source for individual stock ideas and for learning the latest news/trends in the Investment community.”

Jay Petschek, Founder and Managing Member, Corsair Capital Management, L.P., $1 billion-plus long/short hedge fund[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]

Hedge Fund Alpha is a fraction of other services… Yet, the ROI could be incredibly high…

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]You may get worried about what Hedge Fund Alpha cost? Were you worried it would cost $5,000? Well…[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]

Hedge Fund Alpha costs… Just $399 per year

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text]The same level of sophisticated information will usually cost thousands of dollars a year with prices rising continuously… yet right now, you can become a member of Hedge Fund Alpha and lock in a low price of just $399 per year.

Now $399 is not nothing but let us talk about potential returns.

Remember those examples I gave earlier.

- If you had invested just $10,000 in The Trade Desk, you would have gained a $74,000 profit in less than three years.

- If you had shorted HEBT, you would have gained a $5000 profit in just a few hours.

- If you had used $1000 to short Akazoo, you would have earned a $4500 profit in just a couple of days.

As is evident, if you invested in any ONE of these, you would have made a killing, and the subscription would pay itself many times over.

Keep in mind these are just a few of hundreds or thousands of write-ups we have done. Plus, we are putting out more quality content DAILY.

Bottom line …[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space height=”60px”][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content” css=”.vc_custom_1620660634531{background-color: #d2edfe !important;}”][vc_row gap=”20″ css=”.vc_custom_1620577569463{background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}” el_class=”customcolumn”][vc_column width=”2/3″ el_class=”customcolumn”][vc_empty_space height=”60px”][vc_row_inner][vc_column_inner width=”1/4″][vc_single_image image=”2100386″ img_size=”medium”][/vc_column_inner][vc_column_inner width=”3/4″][vc_column_text]Your membership in Hedge Fund Alpha comes with everything mentioned earlier. We are sure you will love it, and indeed, the vast majority of our readers stay beyond the trial.

If you’re not totally satisfied with your membership, ask us for a quick and no questions asked refund. In fact, you have 30 days to decide if Hedge Fund Alpha works for you. If it’s not, email our fantastic team support@hedgefundalpha.com.

We want you to be as ecstatic about Hedge Fund Alpha as we are. So if you’re not, you receive a full refund with no questions asked!

Will you take the red pill and improve your financial future?

Maybe you’re still on the fence about Hedge Fund Alpha; even though the ROI is insanely high, it still costs a few hundred dollars. Now you have a simple decision … you can take the blue pill and forget you ever read this and search around for this information you may get (perhaps).

OR …

You can take the red pill, join Hedge Fund Alpha and get access to everything and much more, all with a 100% money-back guarantee. I’m hopeful and confident you will make the correct choice for your financial freedom.

Jacob Wolinsky

Chief Executive Officer, ValueWalk

P.S. Retirement funds can also be used!

Many of these hedge funds have tax free options for IRAs, 401Ks and more. Make sure to check with your accountant, but you should have many alternatives if you are a qualified investor. And as always, you can also copy their hedge fund trades directly in any brokerage account.

Let us join together in getting financial freedom.[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space height=”60px”][vc_empty_space height=”” el_id=”subscribeform”][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content”][vc_row gap=”20″ css=”.vc_custom_1620577569463{background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}” el_class=”customcolumn”][vc_column width=”2/3″ el_class=”customcolumn”][vc_empty_space height=”60px”][vc_row_inner][vc_column_inner][vc_column_text][register_form ids=”28,41″][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space height=”60px”][/vc_column][/vc_row][/vc_section][vc_section full_width=”stretch_row_content” css=”.vc_custom_1620583224183{background-color: #020202 !important;}”][vc_row gap=”20″ css=”.vc_custom_1620577569463{background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}” el_class=”customcolumn”][vc_column width=”2/3″ el_class=”customcolumn”][vc_empty_space height=”30px”][vc_row_inner][vc_column_inner][vc_column_text]

Disclaimer: VALUEWALK LLC is not a registered or licensed investment advisor in any jurisdiction.

Nothing on this website or related properties should be considered personalized investments advice. Any investments recommended here in should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

VALUEWALK LLC, its managers, its employees, affiliates and assigns (collectively “The Company”) do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

The Company is not affiliated with, nor does it receive compensation from, any companies mentioned.

The Company disclaims any liability in the event any information, commentary, analysis, opinions, advice and/or recommendations provided herein prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

Problems Ordering?

Email us at support@hedgefundalpha.com

© VALUEWALK LLC 2011-2021 – All rights reserved

[/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space height=”30px”][/vc_column][/vc_row][/vc_section]